From Social Media to Macroeconomics: ALERTA-Net and the Future of Stock Market Analysis

The world of finance is on the verge of change. Having a significant impact on other business sectors, the stock market serves as an important mechanism and key factor for companies to raise capital. With US stock market assets expected to grow to $40 trillion in 2023, equal to 1.5 times the country's GDP, it represents a significant portion of the overall economy, highlighting its important position as a benchmark for the American economic landscape.

Two prominent scientists from South Dakota State University - Kaiqun Fu, an experienced assistant professor in the Department of Electrical Engineering and Computer Science, together with graduate student researcher Yanxiao Bai presented a very interesting artificial intelligence model called "ALERTA-Net". This deep neural network gains a unique advantage by combining macroeconomic indicators, search engine data and social media context. It raises the question: can AI tools be the key to predicting stock movements and stock market volatility? Let's take a closer look at these innovative studies and their potential impact on the financial landscape.

Their research focuses on blue chip stocks, which reflect broader stock market dynamics. Blue chip stocks are shares issued by financially sound, well-established companies with an impeccable reputation.

The researchers selected 41 blue chip stocks from 10 sectors according to the Global Industry Classification Standard (GICS) to study the financial market. Each of these stocks is considered an investment prospect by both Moody's and S&P. Given the known difficulties of accurately forecasting stock prices, scientists have decided to use blue chip stocks to predict upcoming stock price movements and volatility trends.

Two main methodologies prevail in stock market research: technical and fundamental analysis. Technical analysis uses previous stock prices to predict future trends. However, its heavy reliance on historical data can sometimes miss sudden market changes due to unexpected events. Assuming a uniformly rational market behavior, this methodology can sometimes create a random echo chamber, making trading signals isolated from the real economic context.

Fundamental analysis, on the other hand, integrates both price characteristics and external information, including data from social media and search engines. This approach demonstrates improved accuracy in forecasting the close of the S&P 500 Index when integrating Twitter data into its model. While these data sources often reflect not only the financial market but also important economic indicators, the predominant research in fundamental analysis tends to emphasize the financial market, neglecting the symbiotic relationship between the overall economy and the stock market. Moreover, existing models mainly focus on predicting shifts in trends, often neglecting the importance of the scale of these changes. But in the area of stock behavior, the scale of these shifts is significant.

In their article, published on the arXiv preprint server, the researchers propose a new model that combines both approaches. ALERTA-Net – Attentional TemporaL DistancE AwaRe RecurrenT NeurAl Networks. The proposed framework allows combining data from social networks, macroeconomic indicators and information from search engines to predict stock price movements and volatility.

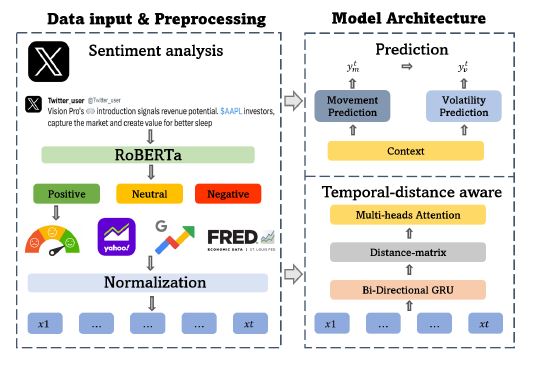

Let's consider the general architecture of ALERTA-Net. The data input and preprocessing layer converts both temporal and textual information into dense vectors. Then, the distance-aware temporal layer has a recurrent representation that identifies hidden dependencies in current stock data based on past information. The distance matrix context then integrates these historical dependencies into a sequence of features. And finally, the forecast layer generates time-adjusted stock movement and volatility forecasts for the next time interval, thereby providing a complete and coherent system for stock forecasting.

The ALERTA-Net architecture is designed to predict the movement and volatility on day t. The data input and preprocessing phase extracts textual information from Twitter and converts it into sentiment scores. ALERTA-Net then uses these sentiment scores along with other features to make predictions based on temporal distance.

In order to validate the effectiveness of the proposed model, experiments and comparisons were carried out on one real dataset. The dataset provides sentiment scores for 41 blue chip stocks and combines three main components: price data, Twitter sentiment data, and macroeconomic data.

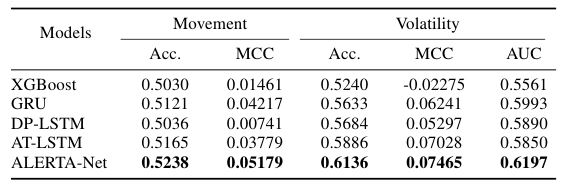

The performance of ALERTA-Net was evaluated by comparison with DP-LSTM, a well-known stock movement prediction network based on financial data. Other benchmarks used in the study include Extreme Gradient Boosting, attention-based LSTM, and GRU. The results are defined in terms of accuracy and Matthews Correlation Coefficient. Given that data points involving stock price changes of more than 5% constituted only a small portion of the dataset, it was decided to use the area under the ROC curve (AUC) as a performance measure to achieve a more reliable and realistic forecast. The results are shown in the table below.

With ALERTA-Net, it becomes possible not only to predict stock price movements, but also to effectively obtain information about stock market volatility. This allows you to anticipate any unusual fluctuations in the stock market in the future.

ALERTA-Net has proven itself in recognizing dynamic, temporal, distance relationships embedded in various hidden states. By using same-day stock price movements, the model significantly increases its accuracy in predicting stock market volatility.

Overall, ALERTA-Net, a deep generative neural network architecture, has demonstrated the effectiveness of combining search engine data, macroeconomic indicators, and social media data in attempting to forecast stock movements and volatility. In future studies, the researchers plan to improve accuracy by integrating multiple text and audio sources, including earnings calls and financial statements.